2024 Tax Brackets For Seniors Over 65 Single Women Over 70

2024 Tax Brackets For Seniors Over 65 Single Women Over 70 – There are seven federal income tax brackets for 2023 and 2024. Your tax rate is determined by your income and tax filing status. Many or all of the products featured here are from our partners who . Most taxpayers over 65 will only be able to take an additional $1,500 through the standard deduction when they file 2023 tax returns in $13,850 for single filer or married but filing .

2024 Tax Brackets For Seniors Over 65 Single Women Over 70

Source : www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Turkey Raises Minimum Wage by 49% in 2024, With Inflation Headed

Source : www.bloomberg.com

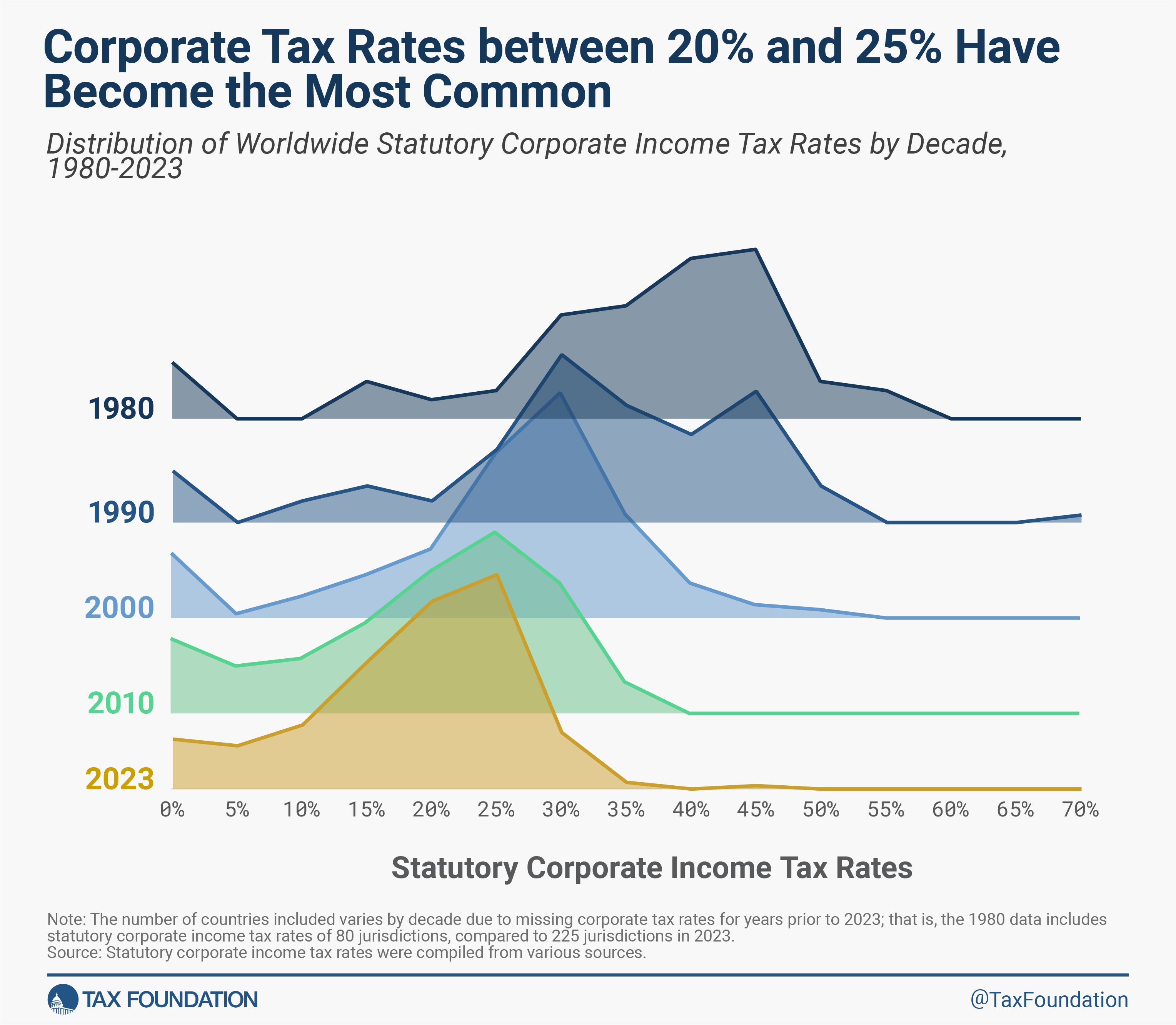

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Our 2024 Bingo Card: Predictions About Trump, the Economy, AI and

Source : www.bloomberg.com

2024 Tax Brackets For Seniors Over 65 Single Women Over 70 IRS Sets 2024 Tax Brackets with Inflation Adjustments: Here’s a guide to tax counseling for the elderly. • After turning 65, the standard deduction for single seniors needed to begin taking distributions from retirement accounts at age 70 . Specifically, the pre-2018 tax brackets meant spouses were often in a higher tax bracket than if they were single with the same income. Low commission rates start at $0 for U.S. listed stocks & ETFs*. .